World shipping-container crisis explained

“Supply chain crisis” became an often-used phrase during the coronavirus pandemic as Covid-19 caused vast economic disruption across the world. It has been used to explain bare supermarket shelves and why goods are taking much longer to reach businesses and consumers. The pandemic has laid bare vulnerabilities in the global shipping industry, which remains affected by a shortage of crew, available containers in Asia and capacity at major ports in the United States and Europe.

Origins

About 90 per cent of the world’s trade is transported by ship. When many countries went into lockdown in early 2020, restrictions on peoples’ movements resulted in significant changes in consumption patterns. Demand increased for certain goods, like home office supplies and electronics, many of which are made in China and other manufacturing hubs in Asia. There was also an urgent need for raw materials for medical supplies as well as masks and personal protective equipment (PPE).

Nearly every company in the world was forced to adapt to the health crisis, including airlines, which converted passenger aircraft for cargo as borders closed to international visitors.

Shipping rates

The cost of shipping soared during the pandemic, particularly for the world’s busiest routes. In the later part of 2021, the price of shipping from Asia to the US west coast increased to US$26,000 per 40-foot container – almost 330 per cent more than a year earlier and 20 times more expensive than the reverse trip.

VALUE OF MERCHANDISE GOODS

The surge in freight rates and associated costs were largely the result of a mismatch between soaring demand and reduced supply capacity, plus labour shortages and continued on-and-off Covid-19 restrictions imposed in port regions. Ocean transport costs also leapt after a six-day blockage of the Suez Canal in March 2021 caused delays worldwide. It forced some ships to take the long, alternate route around the Cape of Good Hope at Africa’s southern tip – a 5,000km (3,100-mile) detour that cost ships hundreds of thousands of dollars in fuel and other costs.

China port shutdowns

China, the world’s biggest exporter, is a key hub for shipping. The temporary closure of major Chinese ports in 2021 created more headaches for the global logistics and cargo industry. A partial shutdown at Shenzhen’s Yantian Port spanned three weeks in late May and June because of Covid-19 outbreaks in Guangdong province.

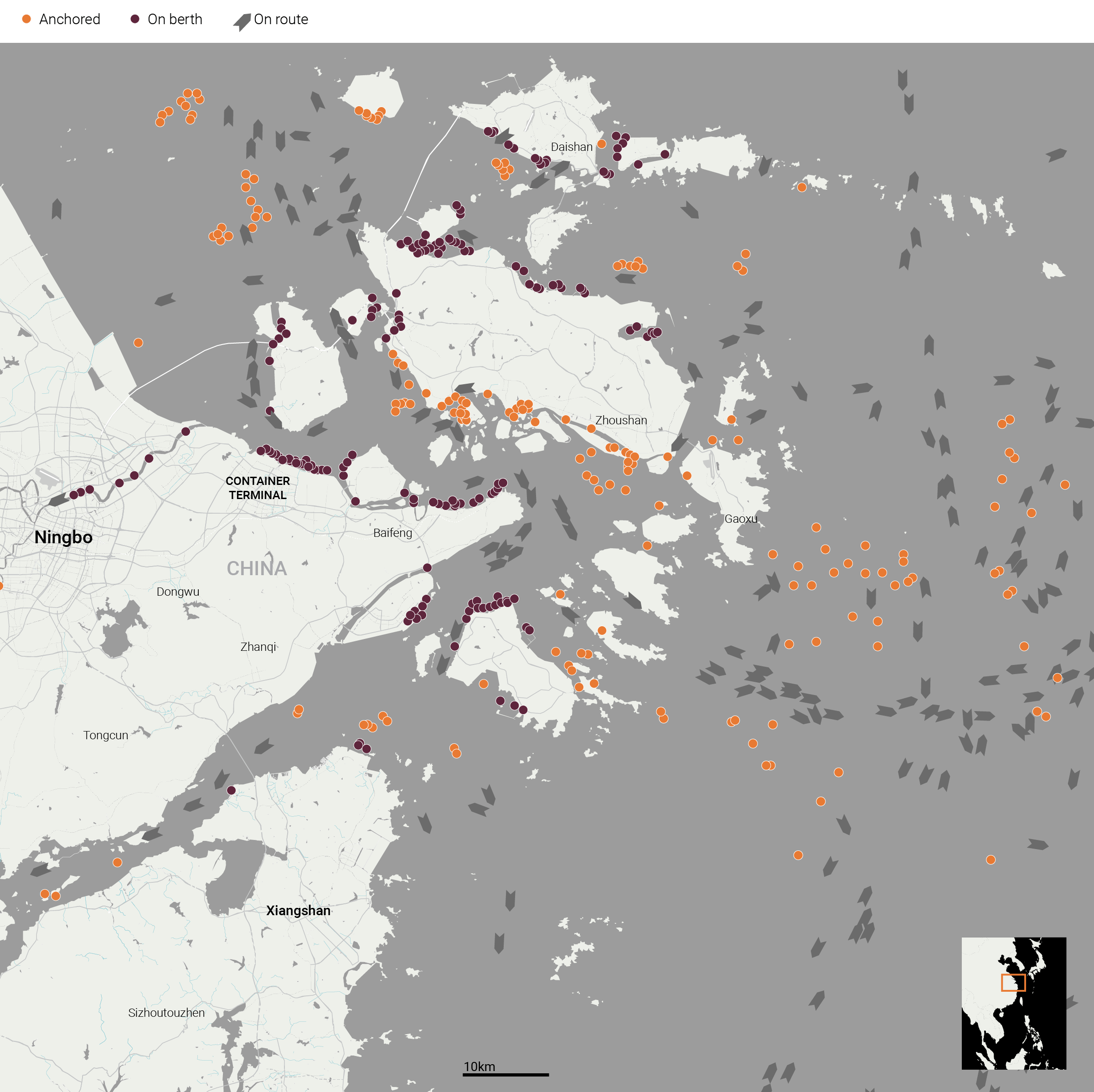

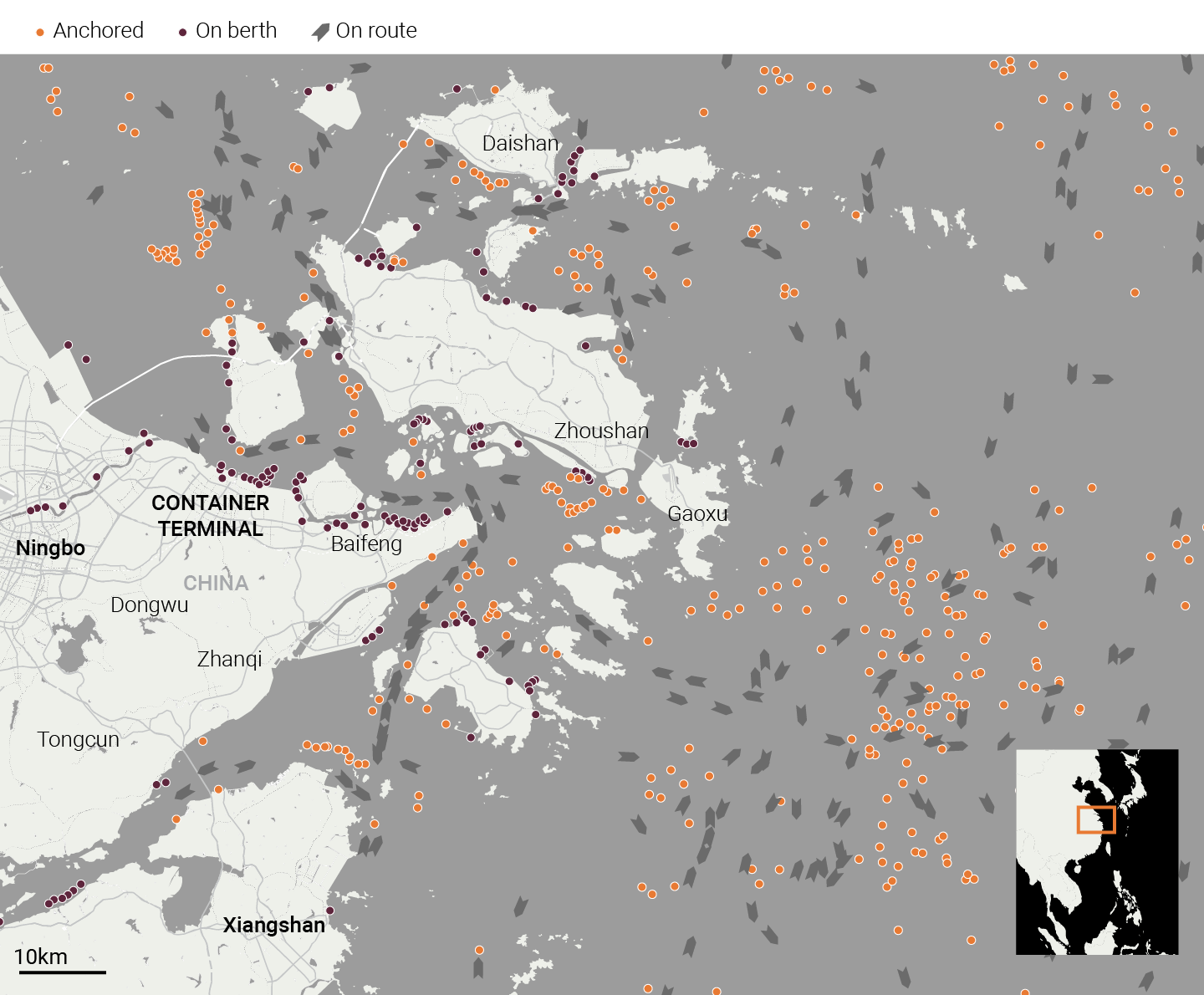

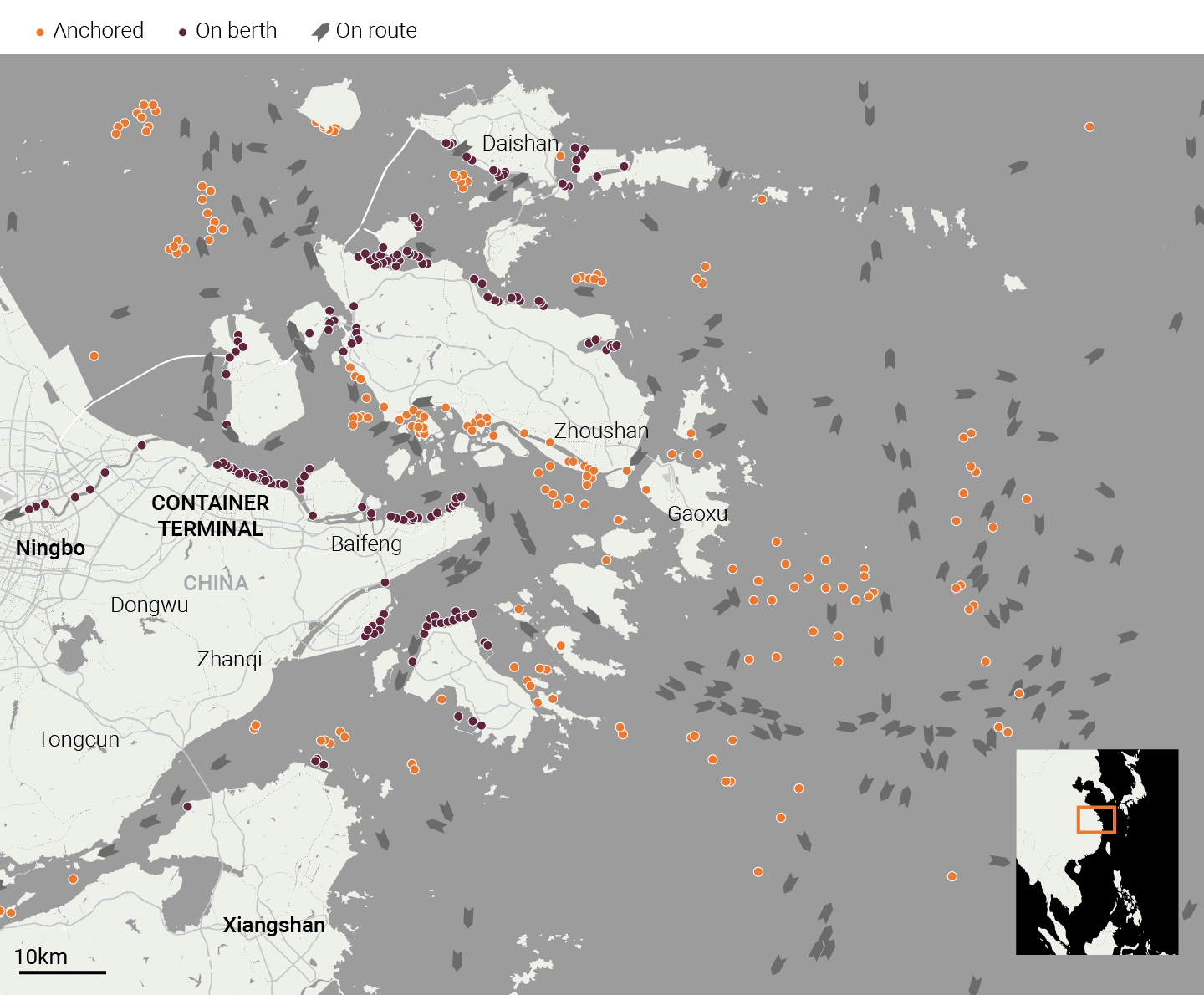

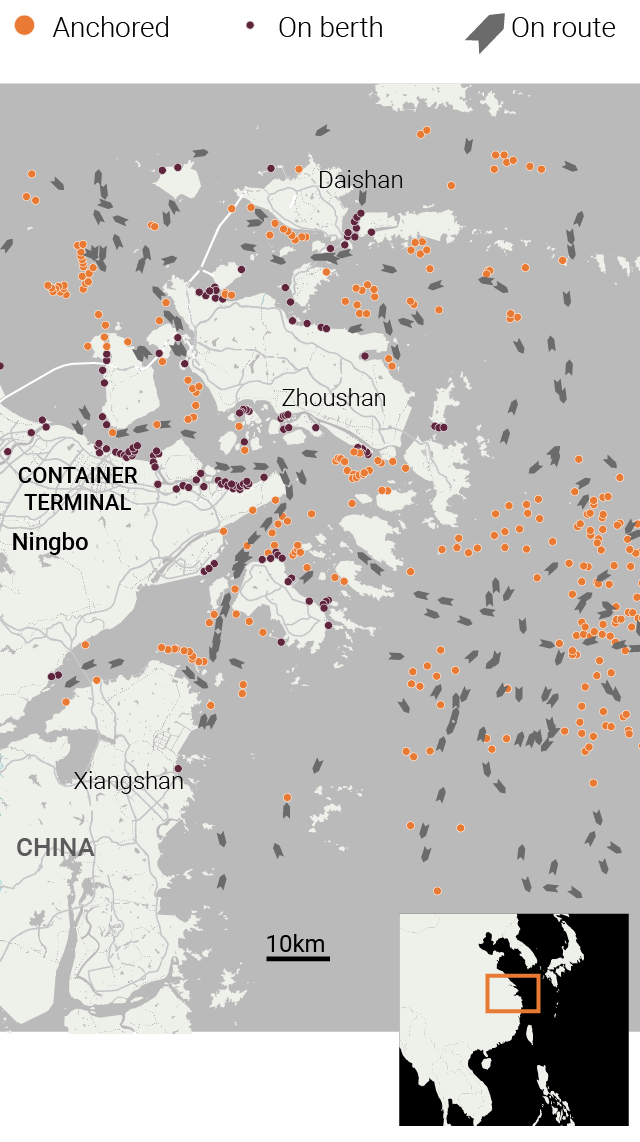

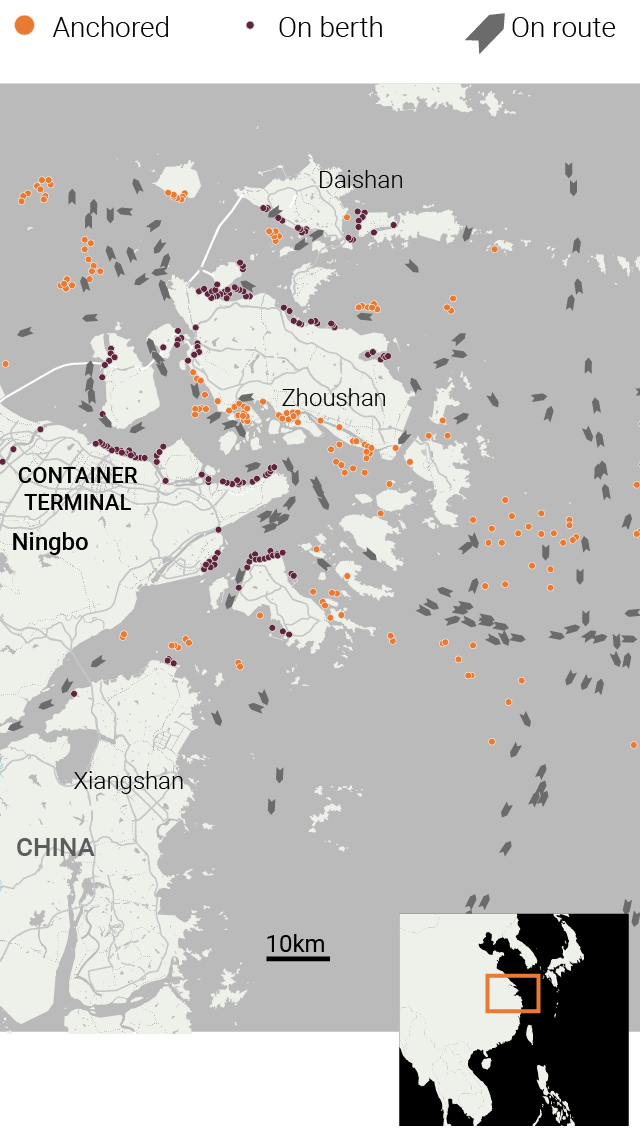

More disruption followed in August when China ordered the two-week closure of a key terminal at Ningbo-Zhoushan Port, the world’s third-busiest, after one port worker tested positive for Covid-19. China is the last country with a zero-Covid strategy, and sometimes orders radical measures to contain outbreaks.

CARGO VESSELS AT NINGBO PORT

The average door-to-door shipping time for ocean freight

Containergeddon

The year 2021 was when “containergeddon” entered the lexicon in the shipping industry. The coined word summed up the state of the industry as it struggled to move containers fast enough to meet exporters’ demands. Backlogs of ships waiting to dock and unload containers at US and European ports meant longer turnaround times to Asia to load new cargo. The ripple effects were felt by businesses and consumers as warehouses became filled with goods waiting to be shipped. China, the world's largest manufacturer of shipping-containers, ramped up production to help meet demand.

Container Availability Index

Shipping containers at two major ports in the US and China in 2020 and 2021

Port congestion

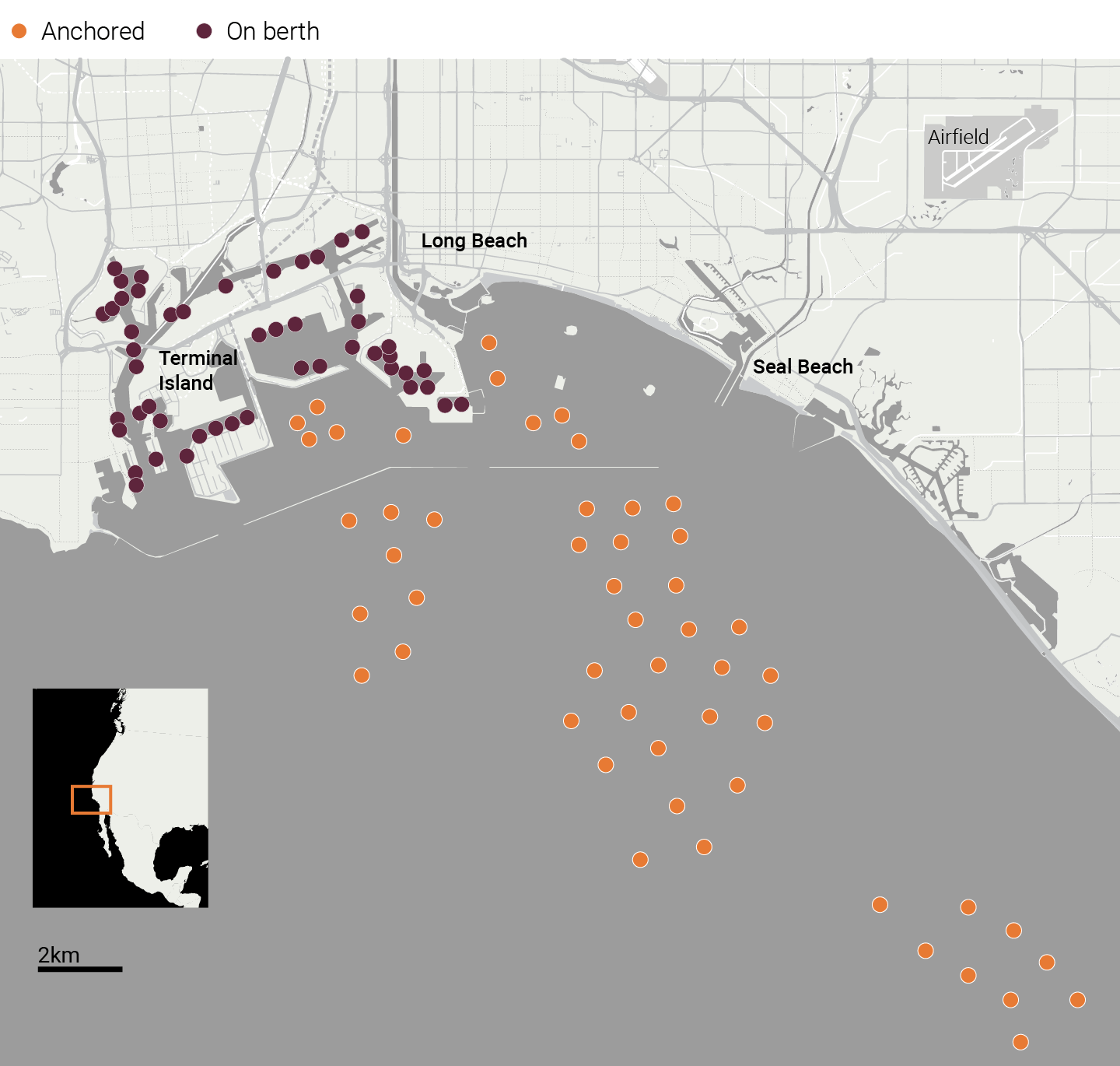

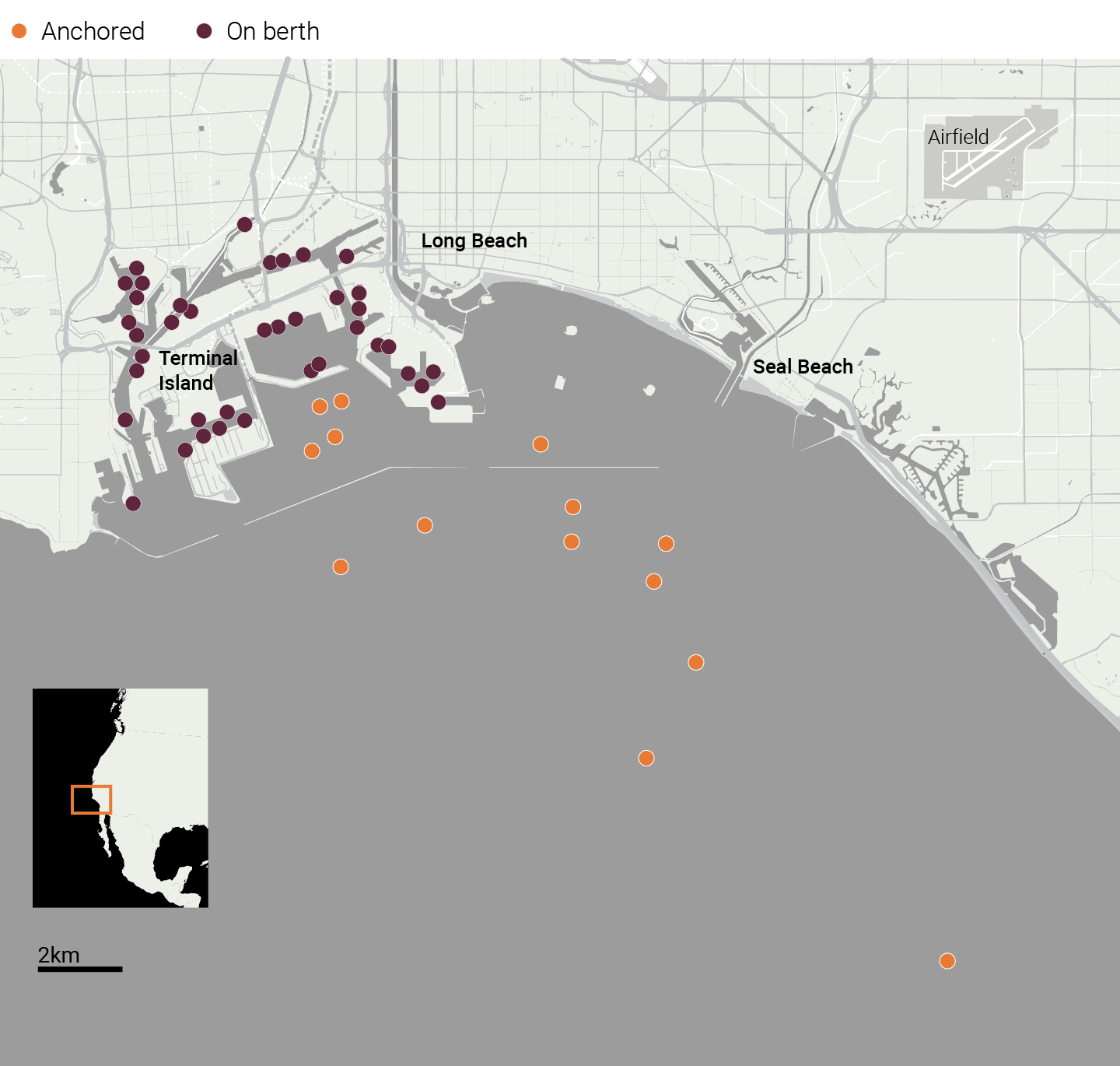

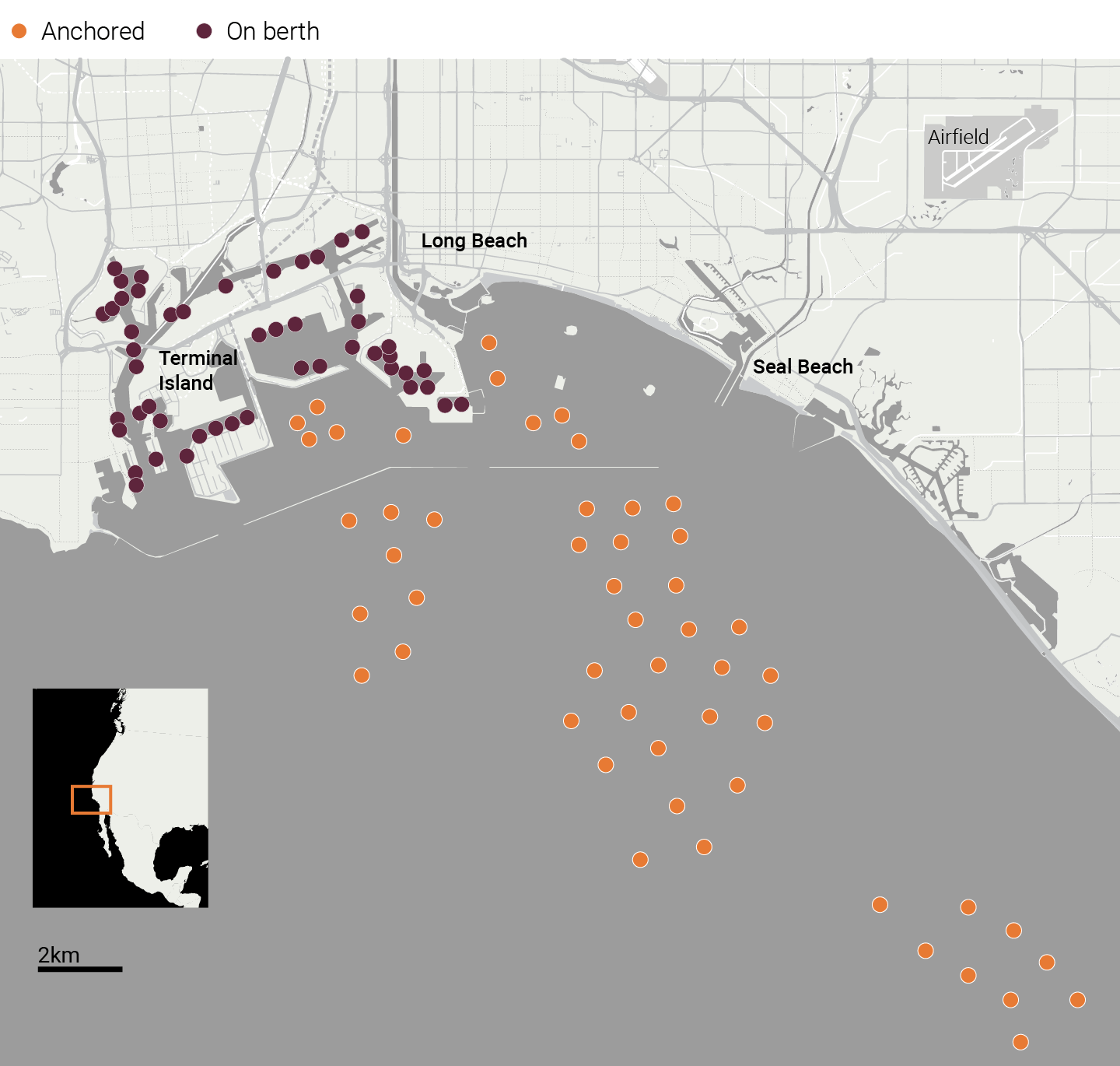

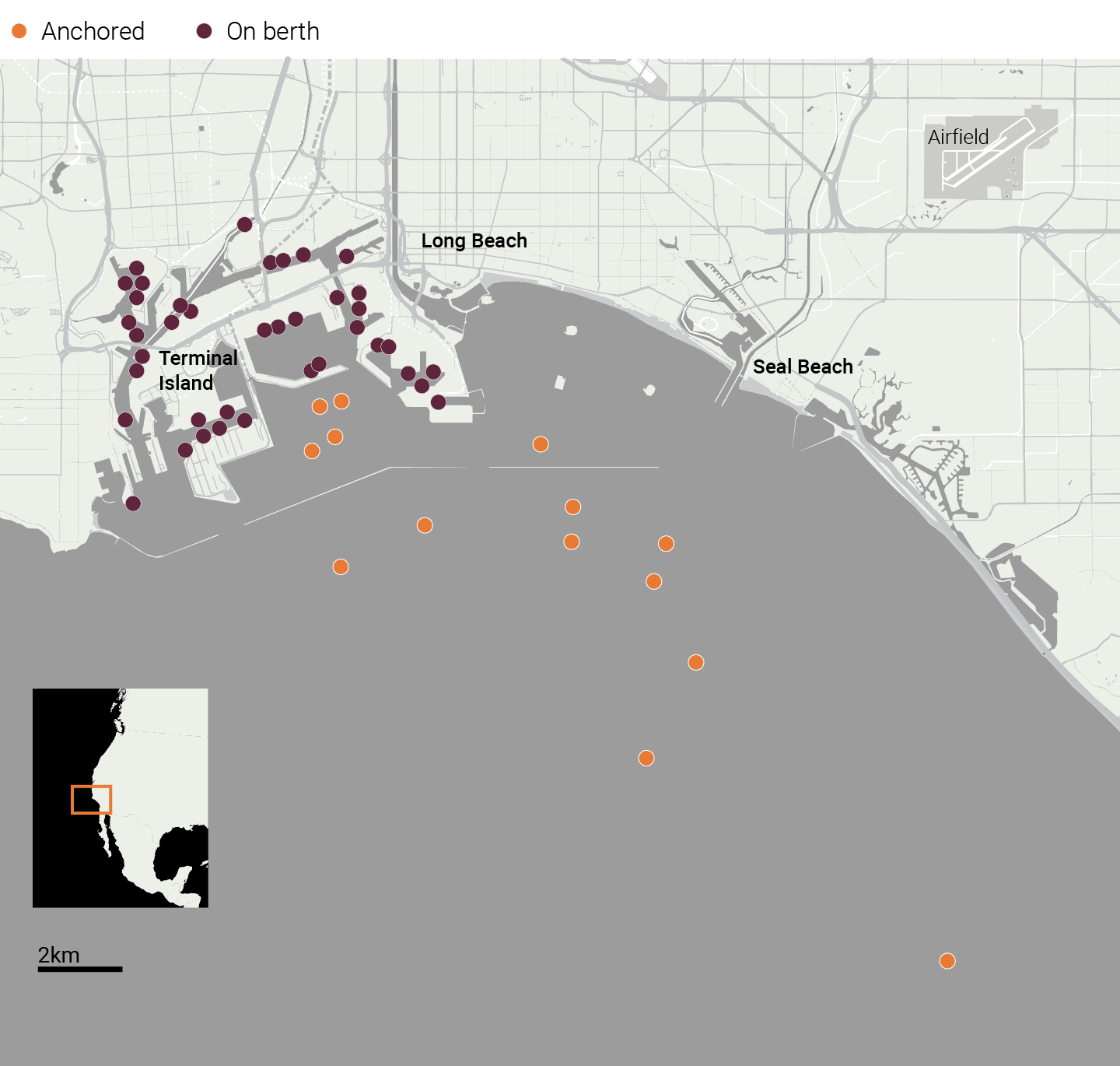

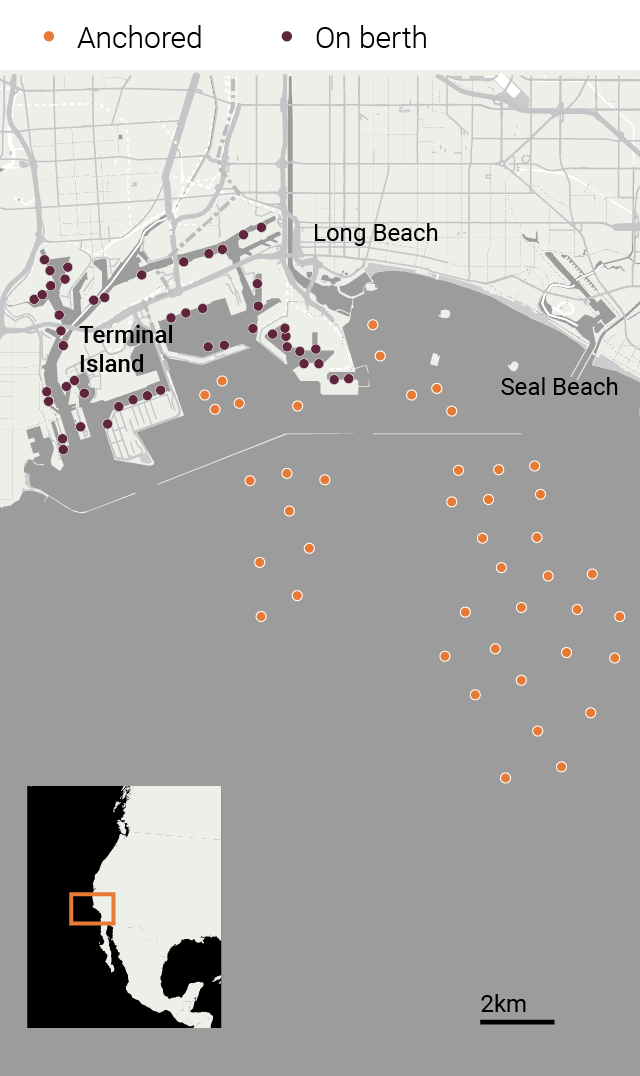

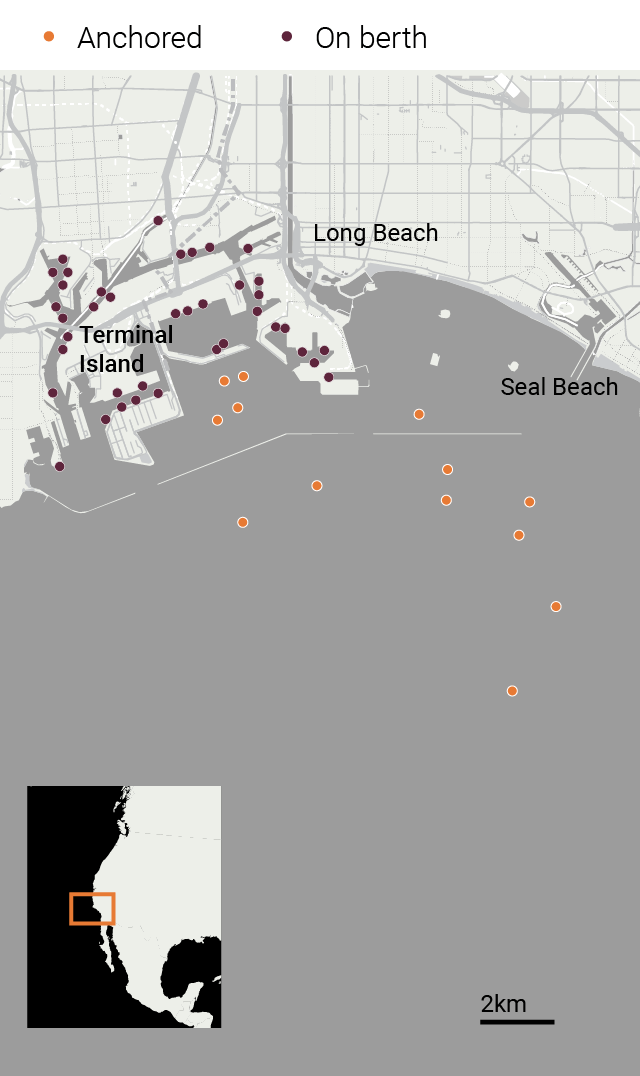

Thousands of container ships were serving the world’s sea routes in 2021. When ships were not sailing or docked, others were idle or forced to wait at sea as some of the biggest and busiest ports struggled to process and unload containers. Port congestion was particularly acute at Los Angeles and Long Beach ports on the US west coast. At their congested worst, dozens of ships queued in sea lanes that stretched for miles.

The Biden administration moved to alleviate the sea traffic jam in October by directing the ports to move to 24/7 operations. Pre-pandemic, it was unusual for more than one ship to be in the waiting lane at Los Angeles Port, the No 1 port complex in the US which handles more than half of all American imports.

CARGO VESSELS IN LOS ANGELES PORT

SHIPPING DELAYS

In 2021, businesses in the United States scrambled to secure Christmas inventory as early as the northern hemisphere summer, because it could take more than 80 days to receive products from China by ship. That was nearly double the usual delivery time.

ACTIVITY IN LOS ANGELES PORT DURING 2021

Outlook for 2022:

The shadow of Covid-19 was still hanging over the start of 2022 as the Omicron variant spread throughout the world. No one really knows when the pandemic will end. However, shipping industry insiders say soaring freight costs and port congestion could last for many more months, perhaps into 2023. “The whole system has become one gigantic bottleneck," said Soren Skou, the chief executive of shipping group Maersk.

Creative Director Adolfo Arranz

Illustrations by Molpasorn Shoowong and Marcelo Duhalde

Additional web development Dennis Wong

Additional Editing Andrew London

Sources: Clarksons Research, Freightos Baltic Index, marinetraffic.com, xChange Solutions GmbH, portoflosangeles.org, freightwaves.com, Ministry of Transport of People’s Republic of China, World Trade Organization, Reuters, Agence France-Presse, Associated Press, Statista